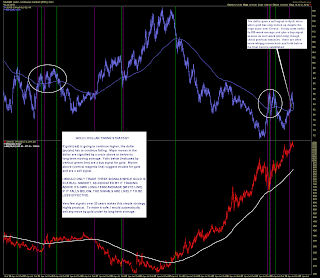

Any economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risks including possible loss of principal. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. This material is for general information only and is not intended to provide specific advice or recommendations for any individual. Historically, the PCE Price Index reverted to lower levels after supply and demand came back into balance and the Fed is expected this time will be no different. As shown in the chart, prices can quickly fall back to a range more comfortable for policy makers. The Personal Consumption Expenditure (PCE) Price Index is the preferred inflation measure for the Fed and is forecast to come back to below 3 percent by the end of 2023. But, cost-push and demand-pull inflationary pressures can revert quickly, which the Fed is expecting. Concurrently, consumers had stimulus checks to spend, diverting funds normally spent on services like vacations and buying durable goods such as recreational equipment and home furnishings. As economies reopened after the depth of the pandemic, inventories were depleted and firms did not have the labor to ramp up production to meet demand. Many global economies are reeling from inflationary pressures which came from a combination of both cost-push inflation and demand-pull inflation. Demand-pull inflation is somewhat related to Milton Friedman’s description of “too many dollars chasing too few goods” although Friedman often ascribed this notion to overly loose monetary policy. As an economy grows and consumer income grows, demand for goods and services increase, perhaps faster than firms can respond with higher output. Whereas, demand-pull inflation historically accompanies a strong economy and rising wages. For example, when a natural disaster inhibits the supply of a raw material, the economy will experience cost-push inflation. Cost-push inflation is typically associated with a price shock in raw materials or increased costs of production. When input prices rise or the cost of labor rises and demand remains unchanged, the overall price level rises from the higher cost of inputs. This scenario is likely when the economy is experiencing cost-push inflation which is described below.ĭrivers of inflation can come from multiple sources. So expect to get more air and less chips next time you buy a snack. Rather than risk losing market share or risk retooling the input process, firms shrink the package and deliver less product to the consumer.

Product downsizing – or shrinkflation – is often the preferred choice for manufacturers in highly competitive markets where individual firms do not have pricing power. In response to these challenges of rising input prices, some suppliers find product downsizing less offensive to customers than outright price increases. Additionally, businesses must cope with rising input costs, a challenge for firms protecting profit margins and also market share. Rising prices put a squeeze on discretionary spending and real wages.

The Fed is rightfully concerned about the nefarious effects of inflation on the consumer.

#Goldilocks scenario drivers#

To understand their projections, we need to understand some of the main drivers of inflation, which are introduced later in this blog post. For the Federal Reserve, the policy objective is inflation humming around 2 percent and the labor market producing a natural rate of unemployment, which is the rate where wage inflation is minimal and labor markets are healthy enough to allow for normal gyrations within the labor force.Īfter the March 15-16 meeting, the Federal Reserve published the Summary of Economic Projections and within this report, FOMC participants’ baseline forecast is a soft landing over the next few years and by the end of 2024, the FOMC is expecting a typical “Goldilocks scenario.” But in the near term, the largest risk to their outlook is their projected inflation path. If the economy is at trend growth and is not experiencing exogenous shocks, central bankers will have a reasonable chance of achieving price stability and maximum employment. Policy makers often talk about a “Goldilocks scenario” which is when inflation and economic growth are neither “too hot” nor “too cold”, allowing the economy to advance at just the right temperature.

0 kommentar(er)

0 kommentar(er)